Thursday, May 28, 2009

Saturday, April 18, 2009

tis time to get posting...

hallos!!! its been some time but i havent quite seen this blog in action.. dun 4get abt e fact tt u'll b graded on this!!! n tt there's $$$ to b won in e inter-ct econs blog competition...

so get started on posting!!!

ms tan

so get started on posting!!!

ms tan

Sunday, April 5, 2009

The Credit Crisis Explained

*sees the light*

Pardon my ignorance, but i never really understood the credit crisis, and this really painted a clearer picture for me. Haha. The graphics are really nice, but it could do with a more interesting voiceover :)

some definitions:

Mortgage-Backed Securities - MBS

An investment instrument that represents ownership of an undivided interest in a group of mortgages. Principal and interest from the individual mortgages are used to pay investors' principal and interest on the MBS. Also known as "mortgage pass-through."

When you invest in a mortgage-backed security you are lending money to a homebuyer or business. An MBS is a way for a smaller regional bank to lend mortgages to its customers without having to worry if the customers have the assets to cover the loan. Instead, the bank acts as a middleman between the homebuyer and the investment markets.

Interest Rates

The monthly effective rate paid (or received if you are a creditor) on borrowed money. Expressed as a percentage of the sum borrowed.

Borrowing $1,000 at a 6% interest rate means that you would pay $60 in interest.

Sub-prime Mortgages

Like other subprime loans, subprime mortgages are defined by the financial and credit profile of the consumers to which they are marketed. According to the U.S. Department of Treasury guidelines issued in 2001, "Subprime borrowers typically have weakened credit histories that include payment delinquencies, and possibly more severe problems such as charge-offs, judgments, and bankruptcies. They may also display reduced repayment capacity as measured by credit scores, debt-to-income ratios, or other criteria that may encompass borrowers with incomplete credit histories."

Subprime mortgage loans are riskier loans in that they are made to borrowers unable to qualify under traditional, more stringent criteria due to a limited or blemished credit history. Subprime borrowers are generally defined as individuals with limited income or having FICO credit scores below 620 on a scale that ranges from 300 to 850. Subprime mortgage loans have a much higher rate of default than prime mortgage loans and are priced based on the risk assumed by the lender.

Although most home loans do not fall into this category, subprime mortgages proliferated in the early part of the 21st Century. About 21 percent of all mortgage originations from 2004 through 2006 were subprime, up from 9 percent from 1996 through 2004, says John Lonski, chief economist for Moody's Investors Service. Subprime mortgages totaled $600 billion in 2006, accounting for about one-fifth of the U.S. home loan market

(references: www.dictionary.com)

Eryn

Tuesday, March 24, 2009

Hey S7N-ians!

Eryn has been really "on" about this blog, and keeps nagging at the rest of us to find some stuff to post up here. Having a few spare minutes before bedtime, google has been a really good friend xD

check out this site:

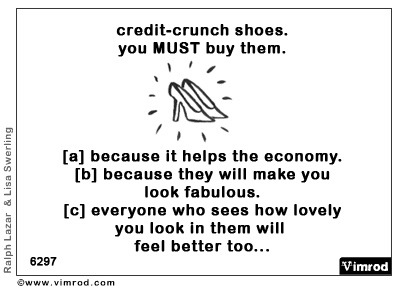

http://www.econosseur.com/economic-jokes.html

there is a whole chunk of jokes in there... some of which i understand... and some are... just to chim for our standard...

anyway, don't just scroll to the pictures to read the comics, some short jokes are quite interesting too. =)

Have fun guys and gals!

Ivan

Eryn has been really "on" about this blog, and keeps nagging at the rest of us to find some stuff to post up here. Having a few spare minutes before bedtime, google has been a really good friend xD

check out this site:

http://www.econosseur.com/economic-jokes.html

there is a whole chunk of jokes in there... some of which i understand... and some are... just to chim for our standard...

anyway, don't just scroll to the pictures to read the comics, some short jokes are quite interesting too. =)

Have fun guys and gals!

Ivan

Subscribe to:

Comments (Atom)